40 math worksheets calculating sales tax

› gross-profit-formulaWhat is Gross Profit Formula?, Examples - Cuemath It excludes the direct income and the expenses. Profitability can be shown by calculating the gross profit using the gross profit formula. Meaning of Gross Profit Formula . Gross profit is the money or profit that a company makes after the selling cost and receiving cost is deducted. It is the amount of profit before all interest and tax payments. Calculating Sales Tax | Worksheet | Education.com | Money math, Money ... May 31, 2013 - Get a thorough explanation of sales tax, and practice with some fun kids' products. May 31, 2013 - Get a thorough explanation of sales tax, and practice with some fun kids' products. Pinterest. Today. Explore. When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore ...

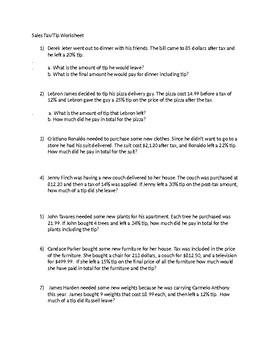

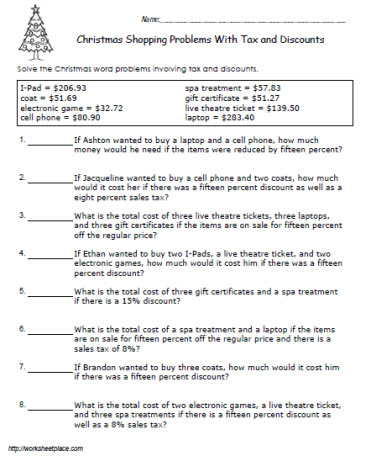

DOC Sales Tax and Discount Worksheet - Chester Sales Tax and Discount Worksheet -Math 6 In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? In a grocery store, a $21 case of toilet paper is labeled, "Get a 20% discount." What is the discount? What is the sale price of the toilet paper?

Math worksheets calculating sales tax

Calculating Tax Worksheets - K12 Workbook Displaying all worksheets related to - Calculating Tax. Worksheets are Sales tax practice work, Work calculating marginal average taxes, Sales tax and discount work, Sales tax and discount work, Income calculation work, Tip and tax homework work, Ira required minimum distribution work, Work for determining support. How to calculate sales tax in Excel? - ExtendOffice In some regions, the tax is included in the price. In the condition, you can figure out the sales tax as follows: Select the cell you will place the sales tax at, enter the formula =E4-E4/ (1+E2) (E4 is the tax-inclusive price, and E2 is the tax rate) into it, and press the Enter key. And now you can get the sales tax easily. › workbooks › fifth-gradeBrowse Printable 5th Grade Math Workbooks | Education.com Math is part of everyday life, so learn math concepts with everyday examples. Learn to calculate sales tax, discounts, income, expenses and how to get more bang for your buck! 5th grade

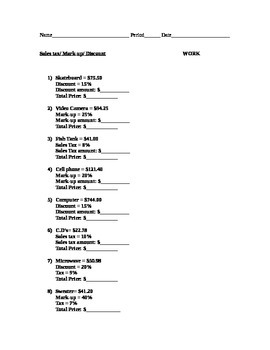

Math worksheets calculating sales tax. PDF Sales Tax and Tip - A Co-Teaching Lesson Plan - Virginia Math 7-Calculating Sales Tax & Tip Strand/Reporting Category Computation and Estimation Topic/Lesson Services and Fees (Determining how much tax and/or tip to apply in real life situations) Standards SOL 7.3-The student will solve single-step and multistep practical problems, using proportional reasoning. Lesson Outcomes Math Worksheets Calculating Sales Tax camiscternben33 s soup5th grade ... Math Worksheets Calculating Sales Tax camiscternben33 s soup5th grade money worksheets free : Entra para leer el articulo completo. › lessons › percentHow To Calculate Discount and Sale Price - Math Goodies Answer: The discount is $3.00 and the sale price is $6.00. Once again, you could calculate the discount and sale price using mental math. Let's look at another way of calculating the sale price of an item. Sales Tax Worksheets Teaching Resources | Teachers Pay Teachers Sales Tax Worksheets by the small but mighty teacher 4.8 (20) $3.00 PDF Activity This product includes 12 worksheets. There are 12 questions on each worksheet, asking students what is the final price with sales tax? With a picture visual of what they are buying as well as the sales tax rate.

PDF Sales Tax and Discount Worksheet - psd202.org What is the sale price of the bicycle? Tax: A tax on sales that is paid to the retailer. You need to add the sales tax to the price of the item to find the total amount paid for the item. Procedure: 1.The rate is usually given as a percent. 2.To find the tax, multiply the rate (as a decimal) by the original price. Seventh Grade / Calculating Sales & Income Taxes - Math4Texas 7.13 Personal financial literacy. The student applies mathematical process standards to develop an economic way of thinking and problem solving useful in one's life as a knowledgeable consumer and investor. The student is expected to: (A) calculate the sales tax for a given purchase and calculate income tax for earned wages. Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Math Courses / NY Regents Exam - Integrated Algebra: Help and Review ... Quiz & Worksheet - Calculating Taxes & Discounts Quiz; ... If it's on sale for 20% off, what is the sale price? $636. $159. calculating commission worksheet Math Worksheets Calculating Sales Tax - Consumer Math Worksheetstaxes lbartman.com. tax sales math discount grade 7th lesson calculating chapter worksheet discounts problems calculate examples problem taxes commission solve worksheets simple. Tax, Simple Interest, Markups, And Mark Downs

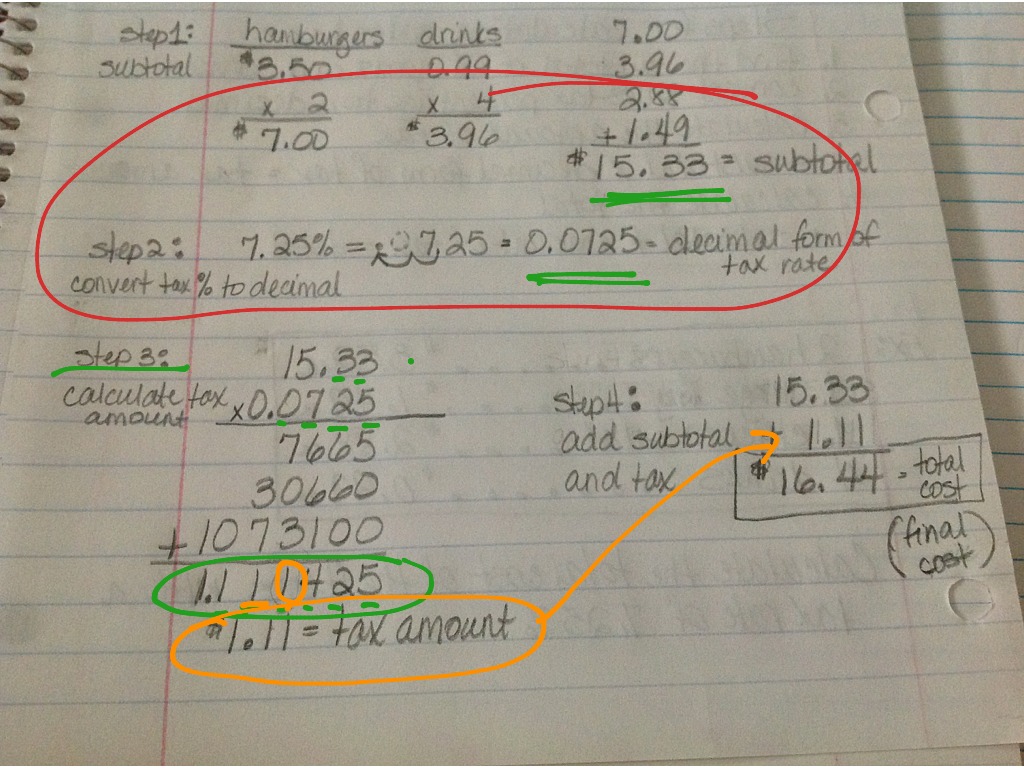

Calculating a Sales Tax Lesson Plan, Worksheet, Classroom Teaching Activity Print out the teaching lesson pages and exercise worksheets for use with this lesson: Printable lesson worksheet and activity. To teach and learn money skills, personal finance, money management, business, careers, and life skills please go to the Money Instructor home page. Teaching Money Calculate Sale Tax Lesson Plan Rules Guide Elementary ... Discount and Sales Tax Lesson Plan, Calculating, Shopping Money Unit ... Discount and Sales Tax Lesson. Optional: Calculators* - Used Sparingly. Discount and Sales Tax Worksheet. Procedure: 1. Warm-up: Review converting percents to decimals. Have students change the following percents to decimals. 55%, 3%, 100%, 1.5%, 33.67%. 2. Motivate the Lesson: Ask students if they ever look at the price tag of toys and clothes ... Calculating Sales Tax | Worksheet | Education.com To figure it out, you'll have to practice calculating sales tax. Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Calculating Total Cost after Sales Tax worksheet ID: 839531 Language: English School subject: Math Grade/level: Grade 5 Age: 7-15 Main content: Percentage Other contents: Sales Tax Add to my workbooks (35) Download file pdf Embed in my website or blog Add to Google Classroom

Calculating Sales Tax Worksheets - K12 Workbook Displaying all worksheets related to - Calculating Sales Tax. Worksheets are Sales tax and discount work, Sales tax practice work, Calculating sales tax, Calculating sales tax, Calculating sales tax, Unit 3, Sales tax tips and discounts, Sales tax tips and discounts. *Click on Open button to open and print to worksheet.

Sales Tax Math Worksheet | Math Free Printable Worksheets Sales tax and discount worksheet 7th grade answer key 5. Buying Camera Math Worksheets Problems Solutions 3 Times Table Free Algebra Answers Year 2 Learning Games Step Sales Tax Worksheet. 5 If the sales tax rate is 725 in California then how much would you pay in Los Angeles for a pair of shoes that cost 3900.

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Sales Tax = $65 x 0.06 Sales Tax = $3.90 Sales Tax = $1.80 If a shirt costs $20 and the sales tax is 9%, how much money do you need to Sales Tax = $20 x 0.09 Total Cost = $20 + $1.80 Total Cost = $21.80 socks that cost $4. If there is an 8% sales tax, how Sales Tax = $4 x 0.08 Sales Tax = $0.32 Total Cost = $4 + $0.32 Total Cost = $4.32

Lesson Plans: Calculating Sales Tax (3-5, Mathematics) - Teachers.Net Ohio's state tax is 5.5%, which is .055. - Multiply this percentage by the retail price of the item (s). This amount is the sales tax. ( .055 x cost of Twister Eraser .35 = .02 ) - Add the sales tax to the retail price of the item (s) to determine the total price of the purchase. 5.

Applying Taxes and Discounts - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount ... Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied.

PDF Calculating Sales Tax - raymondgeddes.com Sales Tax Sales Receipt Worksheet Sales Tax Rate: ____ Sales Tax Rate Converted to Decimal: ___ Receipt #1 Customer Name: Monica Item Name Retail Price x Quantity = Total Price Retro Pencils $.20 5 $ Piranha Sharpener $.50 1 $ 6-Color Pen $.75 2 $ Dessert Eraser $.15 2 $ _____ Subtotal $ Sales Tax Amount $ _____ Total $

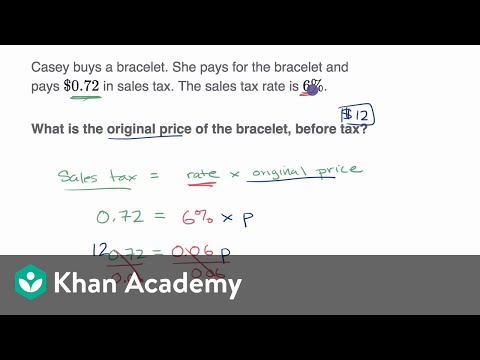

Sales Tax - FREE Math Lessons & Math Worksheets from Math Goodies Analysis: The department store was adding sales tax to the bill. Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer's cost. Solution: 2.36 ÷ $32.00 = 0.0735. Sales tax was charged by the department store at a rate of 7.375%.

› Store › ManeuveringManeuvering the Middle Teaching Resources | Teachers Pay Teachers This digital math activity allows students to practice calculating sales tax and calculating income tax. The activity includes 4 interactive slides (ex: drag and match, using the typing tool, using the shape tool) and is paperless through Google

cotaxaide.org › toolsAARP Tax-Aide Tool List TaxSlayer ® determines the taxable amount of the state tax refund based on sales tax and comparison with the standard deduction. If the taxpayer made estimated payments to the state or had negative taxable income (may show as 0), there may be a better solution.

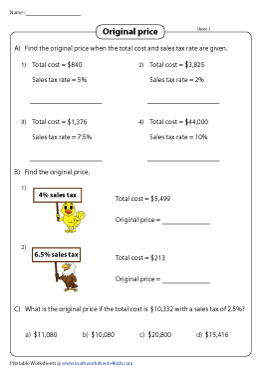

Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values.

Quiz & Worksheet - Calculating Sales Tax | Study.com Calculate the total sale amount of a shirt given the following information: selling price of shirt = $40; sales tax rate = 9%. $3.60 $36.40 $40.00 $43.60 Create your account to access this entire...

softmath.com › math-com-calculator › reducingTi 84 calculator online - softmath online math worksheets for sec 1 ; 6th grade worksheets sales tax ; McDougal Littell Algebra II teachers edition answers ; nys 6th grade math sample tests 2009 ; 1st grade, homework, trouble ; stretch factor of a quadratic equation ; simultaneous equations +interest word problems ; Everyday Math 2007 4th grade unit 7 review download ; Math trivias

How To Calculate Sales Tax: Formula To Use With an Example There are three steps you can follow to use the sales tax formula: Add up all sales taxes. Multiply by the sale price. Add the sales tax to the sale price. 1. Add up all the sales taxes To use this formula, you first need to add up all applicable sales taxes. Start by determining what the sales tax rate is in your state.

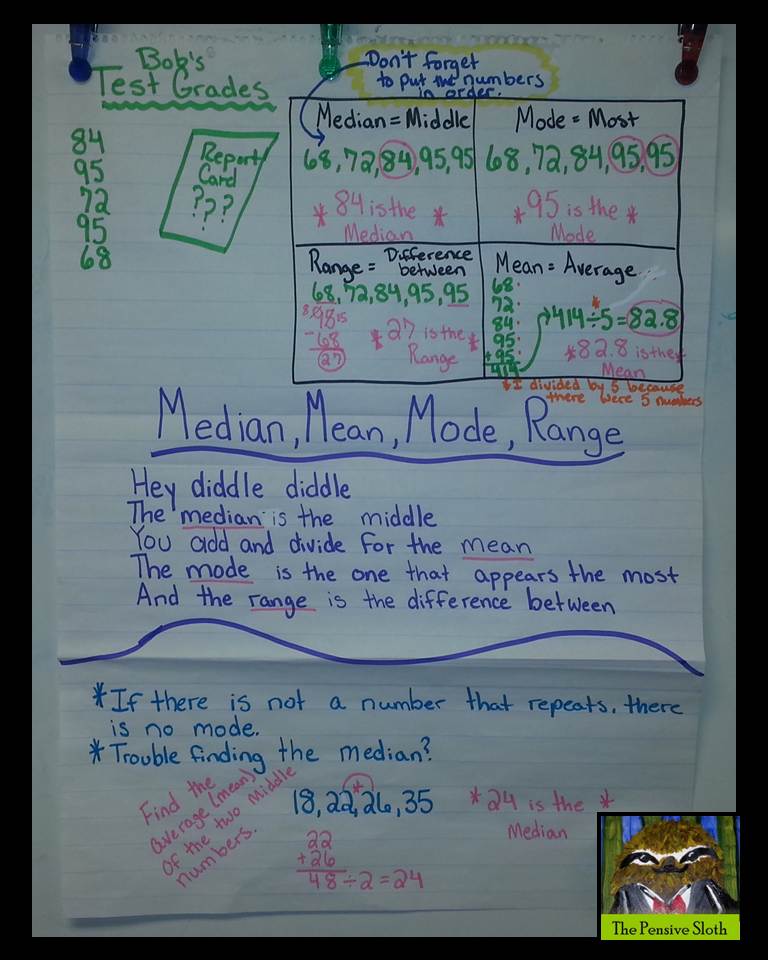

How to Find Discount, Tax, and Tip? (+FREE Worksheet!) - Effortless Math Step by step guide to solve Discount, Tax, and Tip problems. Discount = = Multiply the regular price by the rate of discount. Selling price = = original price - - discount. Tax: To find tax, multiply the tax rate to the taxable amount (income, property value, etc.) Tip: To find tip, multiply the rate to the selling price.

Sales Tax Calculator The price of the coffee maker is $70 and your state sales tax is 6.5%. List price is $90 and tax percentage is 6.5%. Divide tax percentage by 100: 6.5 / 100 = 0.065. Multiply price by decimal tax rate: 70 * 0.065 = 4.55. You will pay $4.55 in tax on a $70 item. Add tax to list price to get total price: 70 + 4.55 = $74.55.

Adding Taxes Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item including taxes

› profit-formulaWhat is Profit Formula? Examples, Method - Cuemath The profit formula helps in calculating the profit earned by selling a particular product, usually in a business, or, to calculate the gain in any financial transaction. Profit can be calculated when the selling price is greater than the cost price. Hence, the formula to find the profit is: Profit = Selling Price (S.P.) - Cost Price (C.P.) Where,

Calculating Tax Worksheet Teaching Resources | Teachers Pay Teachers Each theme has different problems.Each activity packet is designed for students needing to learn to convert percents to decimals, as well as perform calculations to determine the final price after sales tax. There are 8 pages and 3 sections to this product. The first section (2 pages) focuses on writing a percent as a decimal.

› workbooks › fifth-gradeBrowse Printable 5th Grade Math Workbooks | Education.com Math is part of everyday life, so learn math concepts with everyday examples. Learn to calculate sales tax, discounts, income, expenses and how to get more bang for your buck! 5th grade

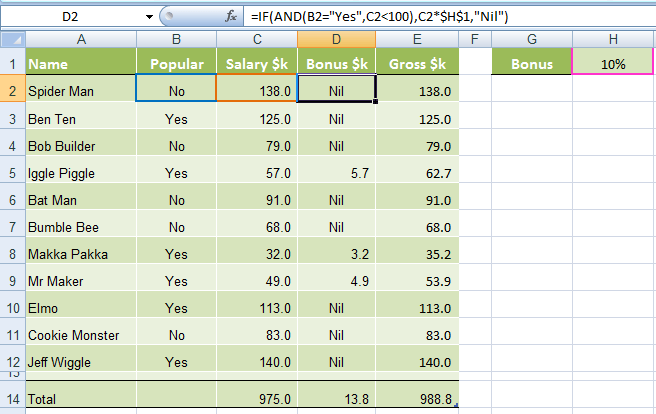

How to calculate sales tax in Excel? - ExtendOffice In some regions, the tax is included in the price. In the condition, you can figure out the sales tax as follows: Select the cell you will place the sales tax at, enter the formula =E4-E4/ (1+E2) (E4 is the tax-inclusive price, and E2 is the tax rate) into it, and press the Enter key. And now you can get the sales tax easily.

Calculating Tax Worksheets - K12 Workbook Displaying all worksheets related to - Calculating Tax. Worksheets are Sales tax practice work, Work calculating marginal average taxes, Sales tax and discount work, Sales tax and discount work, Income calculation work, Tip and tax homework work, Ira required minimum distribution work, Work for determining support.

0 Response to "40 math worksheets calculating sales tax"

Post a Comment